Active Share: Definition, Formula and Limitations

- Emily Sterling

- Nov 14, 2025

- 3 min read

Active Share is a portfolio metric used to determine how much a fund’s holdings differ from its benchmark index. It reveals whether a portfolio manager is truly pursuing an active strategy or simply “hugging” the index while still charging active-management fees.

A higher Active Share means the portfolio is taking distinct positions, while a lower score indicates strong overlap with the benchmark. For investors, it’s an essential tool for evaluating the value and authenticity of active management.

What Is Active Share?

Active Share measures the percentage difference between a portfolio’s holdings and those of its benchmark index. If a fund closely mirrors the benchmark, its Active Share will be low. If it significantly deviates through overweighting, underweighting, or owning unique securities the metric increases.

It ranges from 0% to 100%:

0% = Identical to the benchmark

100% = Completely different from the benchmark

Active Share helps answer the question: Is this manager actually adding value, or simply replicating the index at a higher cost?

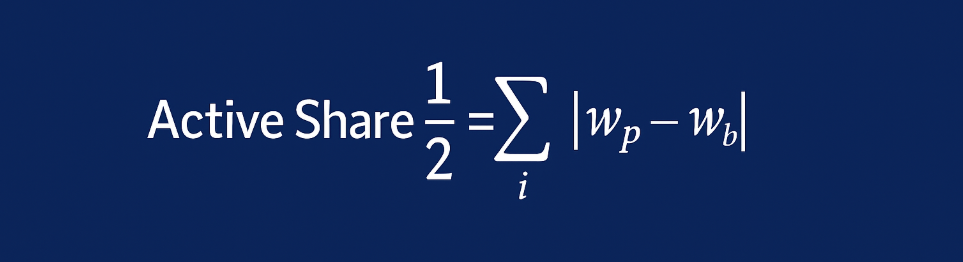

Active Share Formula

Where:

Wp,i = weight of each security in the portfolio

Wb,i = weight of each security in the benchmark

Taking the absolute differences and halving them yields the total percentage of the portfolio that deviates from the index.

Why Active Share Matters

Traditional metrics such as tracking error or beta measure volatility and return relative to a benchmark but they don’t reveal how similar the underlying holdings actually are.

Active Share fills this gap by showing how much discretion the manager is exercising in constructing the portfolio.

A high Active Share suggests a more differentiated strategy, which may outperform (or underperform) significantly.

A low Active Share may indicate index hugging, where investors pay higher fees for a portfolio that behaves almost exactly like a passive fund.

For investors, Active Share is a transparency tool that helps align expectations with results.

Interpreting Active Share

While there is no universal threshold, many analysts use rough guidelines:

0%–20%: Essentially passive

20%–60%: Moderately active

60%–100%: Highly active

High Active Share is most common in concentrated stock-picking strategies, where managers intentionally deviate from broad market benchmarks. In contrast, multi-asset or sector funds often show lower active share due to constraints in their mandates.

Active Share vs. Tracking Error

Although both metrics relate to benchmarks, they measure different types of “activeness”:

Metric | Measures | Best For |

Active Share | Holdings deviation | Assessing stock selection |

Tracking Error | Return volatility relative to the index | Assessing risk and performance variability |

A portfolio can have:

High Active Share + Low Tracking Error (different holdings but similar performance)

Low Active Share + High Tracking Error (similar holdings but volatile outcomes)

Using both together gives a more complete picture of investment style.

Benefits of Active Share

Reveals True Activeness: Helps identify whether a fund is genuinely active.

Supports Fee Analysis: Shows if active fees are justified.

Encourages Transparency: Makes portfolio construction clearer for investors.

Useful Across Strategies: Works for equity funds, quant strategies, and factor-based approaches.

Limitations of Active Share

Active Share should not be used in isolation. Some caveats include:

High Active Share doesn’t guarantee outperformance.

Benchmark choice matters significantly.

Doesn’t account for risk, only holdings differences.

Not ideal for all asset classes, especially those with fewer investable securities.

Combining Active Share with tracking error, Sharpe Ratio, and manager analysis gives a more balanced evaluation.

Conclusion

Active Share has become a widely relied-upon metric for evaluating whether fund managers are delivering real active management or simply replicating an index. By showing how different a portfolio is from its benchmark, it helps investors understand strategy, justify fees, and better match expectations with results.

For anyone comparing funds or analyzing portfolio construction, Active Share is an essential part of the modern evaluation toolkit.